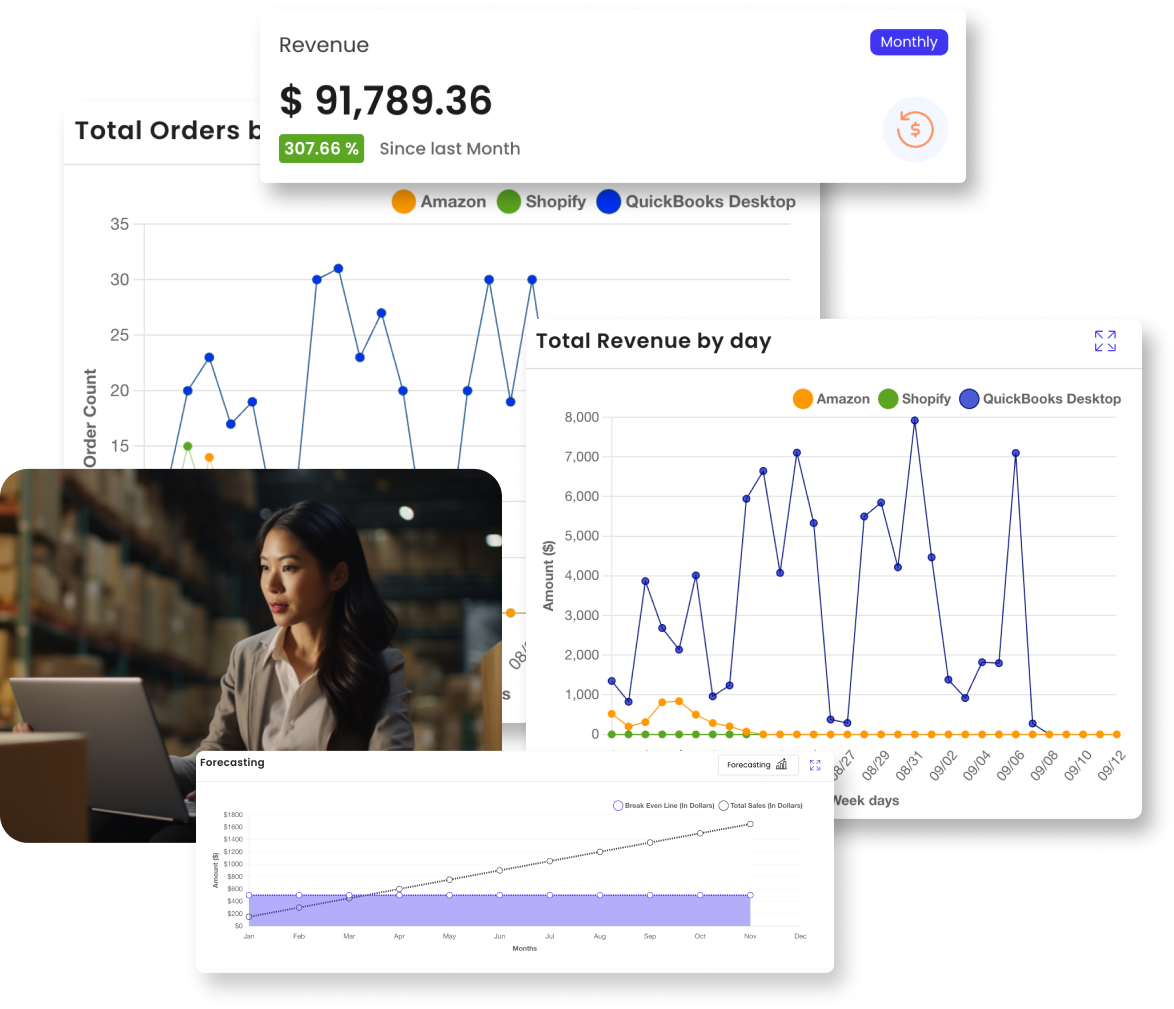

Use the power of analytics and automation to get your e-commerce business to the next level

Connex is the market leader in growth and e-commerce analytics software for small and medium businesses. Designed for e-commerce entrepreneurs, Connex simplifies inventory and financial management, empowering you to make growth-oriented decisions and reach new heights.

How can Connex help you?

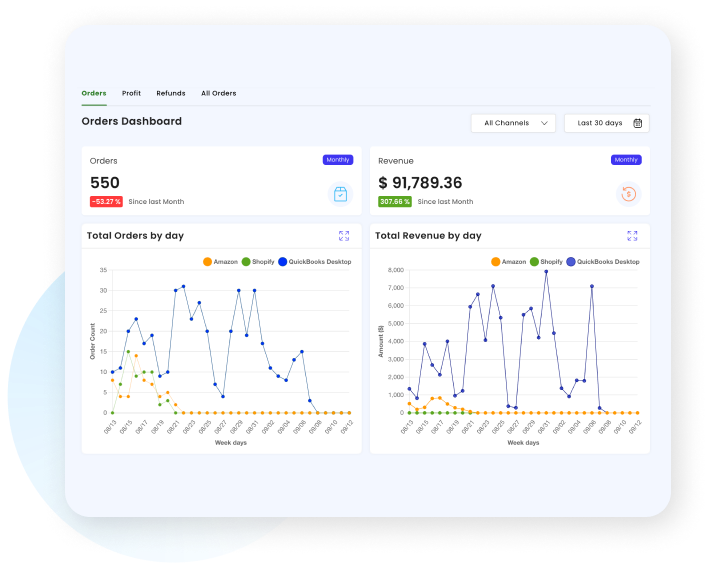

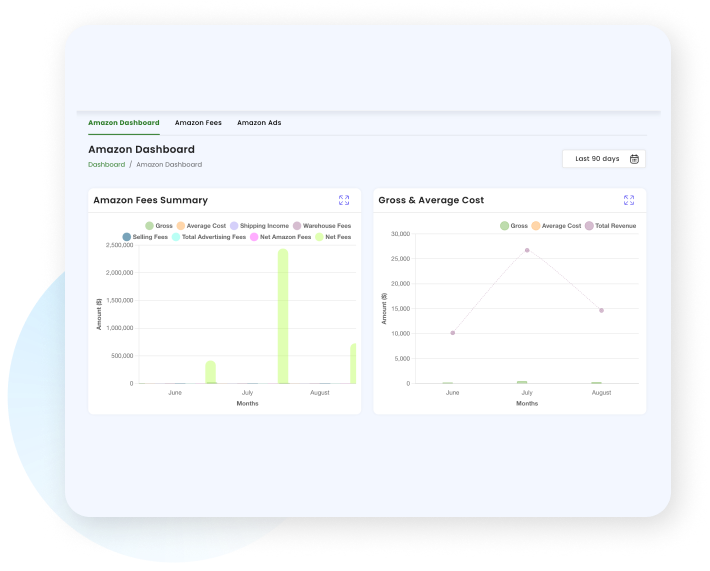

+ Integrate sales data from all your sources

Effortlessly merge your e-commerce platforms with QuickBooks for accurate, real-time financial and inventory insights, simplifying your business management. This seamless integration has proven invaluable for our customers, with many experiencing up to 100% increases in sales, thanks to the power and efficiency of our automations.

+ Reduce manual data entry tasks

Dramatically reduce payroll and manual data entry, accelerate order processing, and enhance fulfillment speed for better operational efficiency and customer satisfaction. This robust approach not only streamlines your business operations but also offers significant time savings, with our average customer saving 10 hours a week.

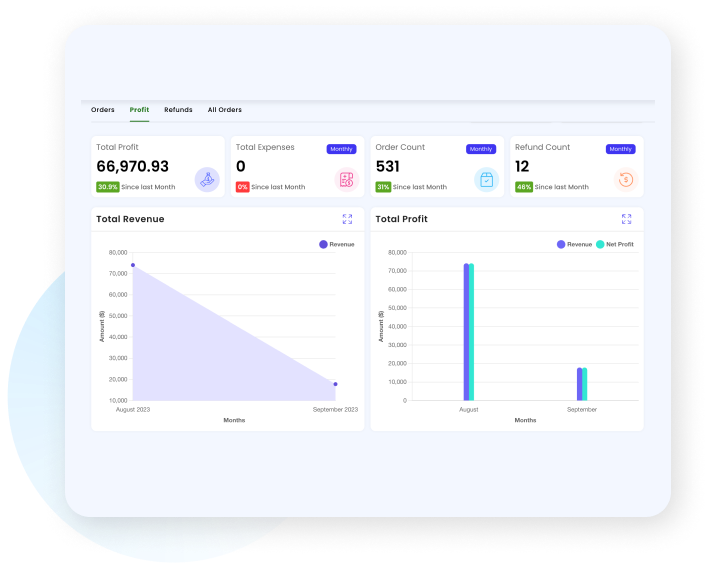

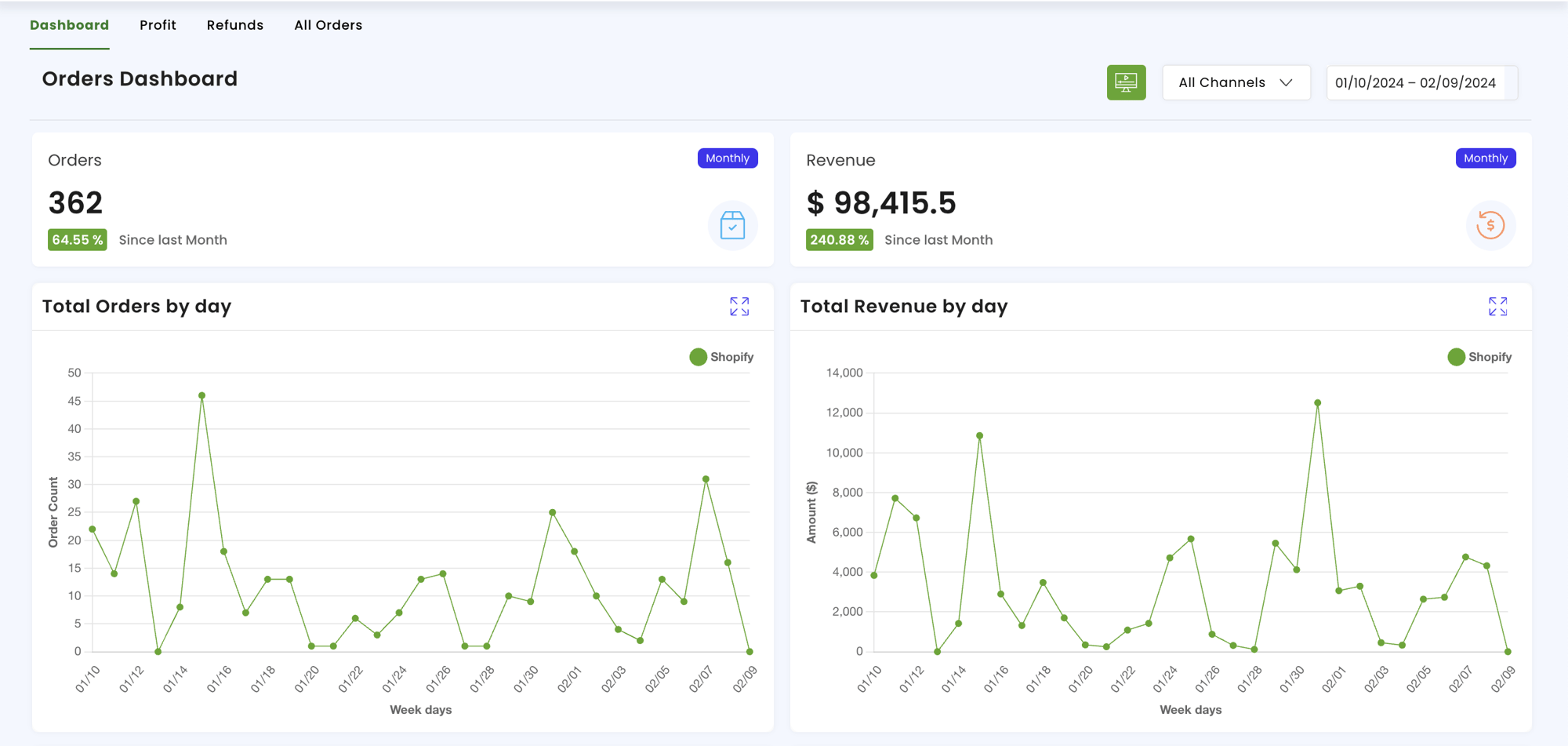

+ Get a clear view of your sales and inventory

Easily reconcile high-volume sales with QuickBooks for enhanced financial accuracy, reduced accounting labor costs, and confident navigation of tax complexities. This efficiency not only optimizes your financial management but also translates into substantial cost savings, as our customers have saved thousands by not overstocking items that don't sell.

Our core products for

ecommerce entreprenuers

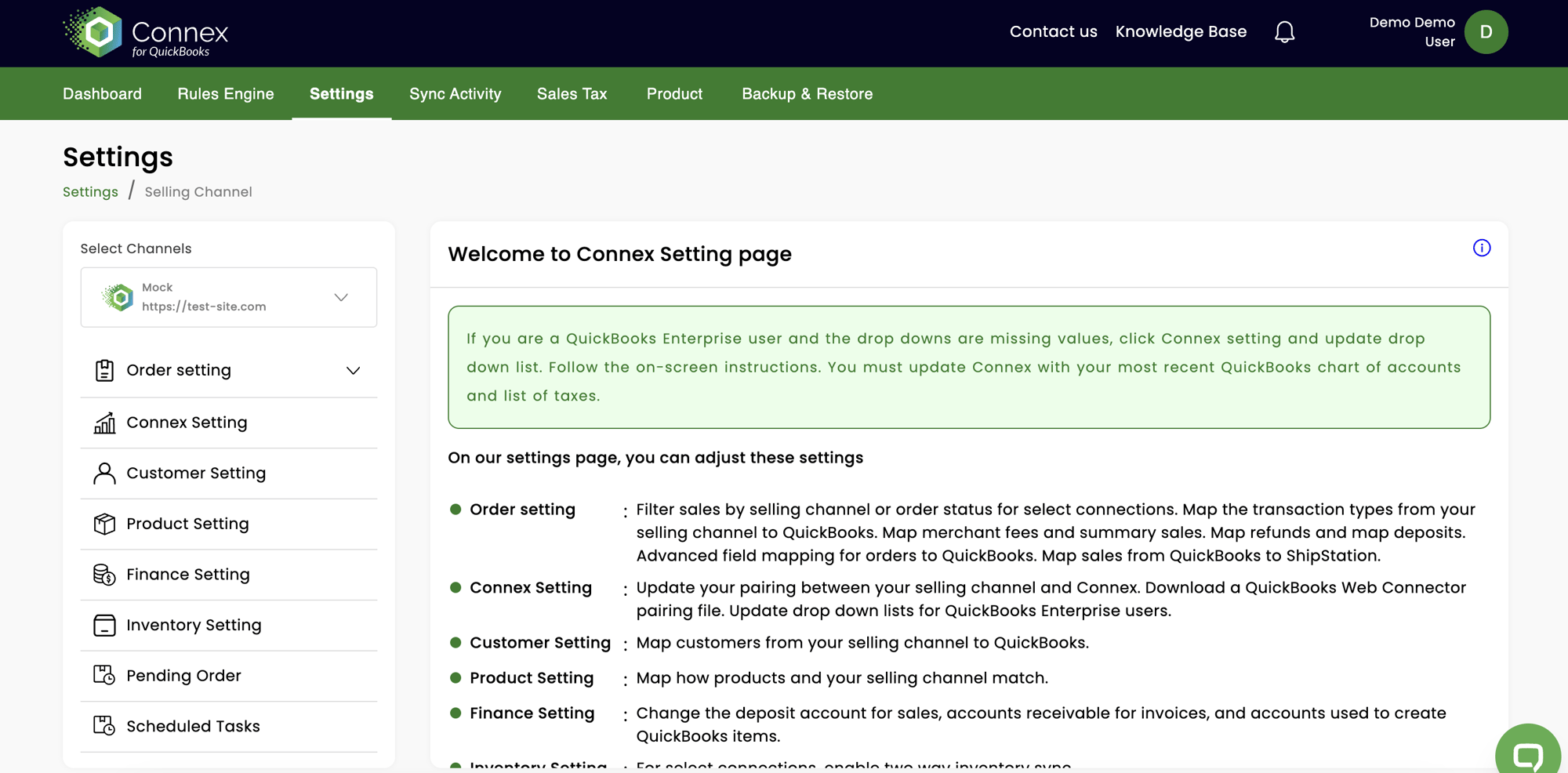

Customizable QuickBooks Automations

Our Rules Engine allows you to customize how you map fields from all of your marketplaces into QuickBooks Online or Desktop editions in one user-friendly interface.

Customizable Inventory Planning

Free yourself from manual inventory planning with spreadsheets. Maximize your sales with the automated Connex Inventory Planner, and connect all your market places to one dashboard.

Testimonials

"Connex is handling our setup very well and support has been responsive. It was relatively straightforward to confirm (prior to purchase) how the systems architecture could work, and I've had very few surprises once I dove in to get it going.

.jpg?width=800&height=564&name=12%20(1).jpg)

"I love that Connex is flexible, customizable, and reliable. It just works, so I don’t ever have to think about syncing my inventory and sales orders from Shopify to QuickBooks. It seems like my accounting team has infinite options for tailoring the connector to our specific needs."

.jpg?width=800&height=564&name=10%20(2).jpg)

I did research after research. Once I came across ShipStation and found that Connex could connect all parts of my workflow, the puzzle finally came together. It’s a domino-effect. Once my job became easier, the pressure has been taken off other people as well. Connex just works and I don’t have to think about it. With Connex, the door opened up for the full ecommerce experience.

It is easy to map our order types. Connex is also user-friendly with the set-up, and support is always helpful. The Connex Team has also been great when needed.

.png?width=800&height=564&name=MicrosoftTeams-image%20(7).png)

Loaded Boards has been using Connex since 2015. It has greatly streamlined our processes and runs seamlessly. We're big fans and recommend Connex highly to anyone using Quickbooks Enterprise and one or numerous channels.

Really glad that we selected this app to sync Shopify with QuickBooks Online. Works seamlessly, and VERY helpful support staff. What I personally really appreciate is the level of customer service provided. They are easy to reach, and very patient with people like me who are new at needing to keep track of online sales.

Our main reason for using Connex was to save time from doing manual data entry. It worked really well for my client, Chinook Farms, so I recommended it to Bare Bones Broth. Once we had Connex running, operations at Bare Bones went much more smoothly. Connex takes only a few hours to set up and run. My favorite part is that it takes care of all the manual work and captures all the important details for accounting.

.jpg?width=800&height=564&name=4%20(3).jpg)

We are stoked on Connex and what it provides. It is mission-critical to have invoices and inventory integrated between Shopify and QuickBooks, and Connex gets it done! This was a solid upgrade from our previous Shopify to Quickbooks Desktop tool. Mostly because of the scheduler and ability to run the connection automatically.

Your product allowing us to keep our Shopify store and QBO accounts, sales & inventory all properly synced continues to be a real help and appreciated value. As well, I would also like to say – as we are a small and not terribly tech-savvy team – your customer service and troubleshooting on the rare occasions we have needed it – has been exemplary.

We love Connex because it’s very hands-off. Matching deposits is a huge feature, and being able to do this properly is amazing! Financial visibility is incredibly important for us as a small business and being able to see this in real-time is a bonus. We plan on using Connex for years to come while we grow our business!

.jpg?width=800&height=564&name=8%20(3).jpg)

When making business decisions, I had to keep in mind that my cost of goods sold (COGS) was different on different sales channels. Keeping the books up to date would have been impossible to do without Connex.

.jpg?width=800&height=564&name=7%20(1).jpg)

I depend on this software. I only have to keep my QB inventory up to date and it’s nice that my website will display accurate inventory. In the past, I have had to update both my QB and my Website. It would take hours a week. Connex saves time by automatically updating inventory and importing orders into QuickBooks.

.jpg?width=800&height=564&name=11%20(2).jpg)

Before Connex, we had to manually enter all our orders from QuickBooks, which was very tedious and prone to human mistakes. We are extremely happy with Connex and we are in the process of finishing our online store, which we will be also using Connex to integrate. Connex streamlined our full operation & saved countless hours!

.jpg?width=800&height=564&name=9%20(2).jpg)

Sync with Connex has been a huge time-saver for us. Having our financial automated is invaluable! What I like most about Connex is their Rules Engine and the flexibility they provide in running my business.

.jpg?width=800&height=564&name=3%20(6).jpg)

Overall, Connex has saved our company thousands of hours and we wouldn’t be able to survive without it! The software pays for itself since we were manually processing all our website and Amazon orders into Quickbooks. Now with it automated, we no longer have any accounting errors! I highly recommend this for anyone who does a large number of Amazon or Shopify orders! 100% worth every penny!

.jpg?width=800&height=564&name=2%20(4).jpg)

Thank you for your continued support of the CONNEX product. As our business has been growing, and transaction volume increasing, Connex has not given us one hiccup!Once again, thank you for the wonderful product and support!

.jpg?width=800&height=564&name=1%20(6).jpg)

We had no way to communicate QuickBooks with ShipStation. Now Connex has bridged the gap between all of Soap and Paper Factory’s outsourced locations. Connex has totally changed our world. We are moving to Amazon, and because of Connex we can!

.jpg?width=800&height=564&name=14%20(2).jpg)

Having one solution that connects with our BigCommerce platform and QuickBooks was great! We have a very strict inventory list and Connex was just the smoothest product out there that was functional and easy to use.